Although the ideal scenario when making a purchase of stock is to see the value of that stock appreciate, sometimes, in a volatile market, even achieving a decline that is lower than the decline achieved by the broader market can be considered a win. A great example of this playing out can be seen by looking at Graphic Packaging Holding Company (NYSE:GPK), a leading provider of sustainable, fiber-based packaging solutions for food, beverage, and consumer products. Driven by robust top line and bottom-line performance lately, shares of the company have declined at a rate that is far less than with the broader market has achieved. Although the company might be more or less fairly valued compared to similar firms, the stock is cheap enough to warrant a ‘buy’ rating in my opinion.

This played out nicely.

Back in early May of this year, I wrote an article that took a rather bullish stance on Graphic Packaging Holding Company. I was particularly impressed by the company's solid operating history, with both organic growth and acquisitions pushing results higher year after year. With data available for just the first quarter, the 2022 fiscal year was shaping up to be quite positive for investors. Add on top of that the fact that shares of the firm were attractively priced, and I could not help but to rate the enterprise a ‘buy’ prospect at that time. When I provide this kind of rating to an enterprise, my assessment is that shares should generate returns that exceed what the broader market can achieve over an identical period of time. So far, that call has proven to be pretty solid. While the S&P 500 is down by 15.9%, shares of Graphic Packaging Holding Company have dropped a more modest 7.8%.

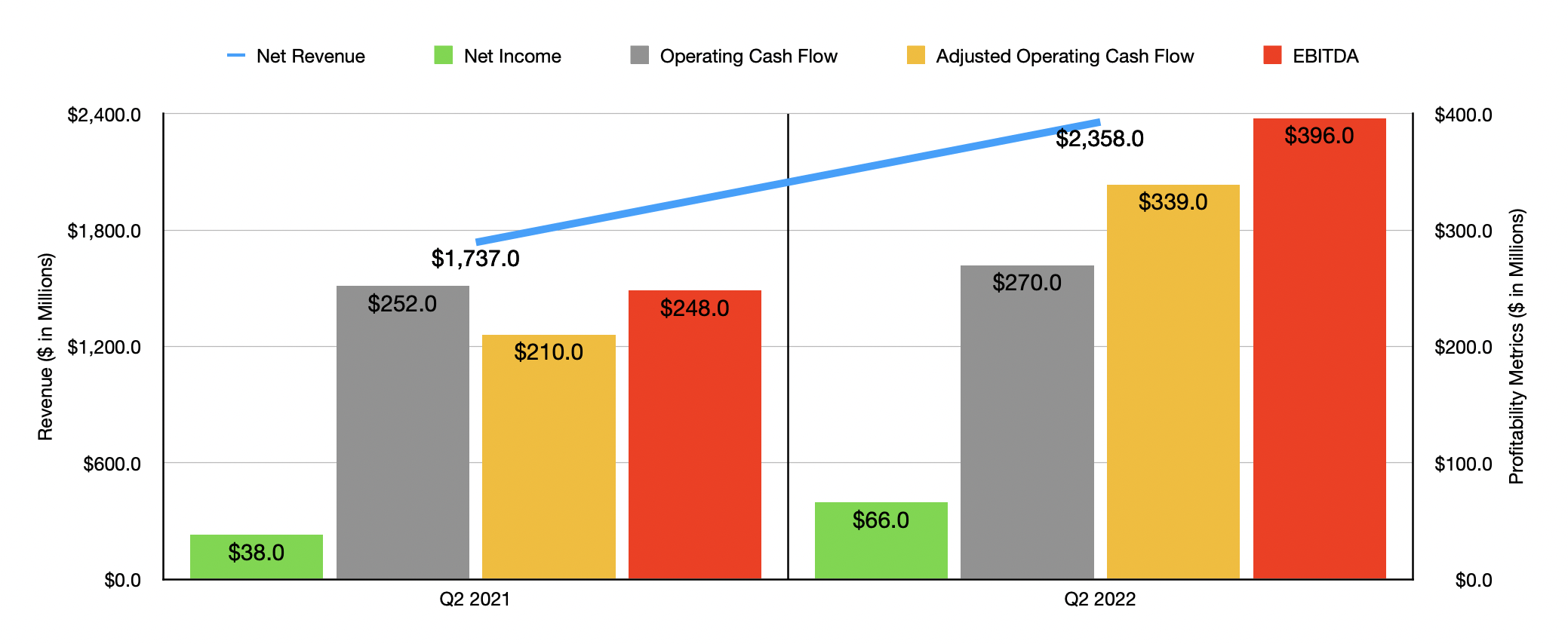

This return disparity is no fluke. To see why results have been this way, we need only look at how the company has performed lately. In the second quarter of its 2022 fiscal year, which is the only quarter for which new data is available that was not available when I last wrote about the firm, sales came in at $2.36 billion. That's 35.8% higher than the $1.74 billion generated the same quarter one year earlier. Of the $621 million increase, $278 million was attributed to higher pricing as management pushed increased costs onto its customers. But the big driver was volume and product mix, contributing $379 million to the company's top line growth. This was offset some, unfortunately, by a $36 million impact associated with foreign currency fluctuations. With revenue rising, profitability followed suit. Net income jumped from $38 million in the second quarter of 2021 to $66 million the same time this year. Even though interest expense surged from $29 million to $48 million, the company benefited from an improvement in its gross margin from 14.7% to 18.7%. This was also instrumental in pushing up other profitability metrics. For instance, operating cash flow rose from $252 million to $270 million...