I develop professional indicators and strategies in Pine Script for TradingView, with a focus on nontrivial, algorithmically complex trading tools.

Most of the projects I take on involve hard problems — the kind where the complexity of the code scales exponentially with the sophistication of what's being detected or computed. To handle this, I've had to push Pine Script well beyond typical usage, leveraging advanced language features like User Defined Types (UDTs), maps, and custom data structures to build systems that would normally require a more flexible language. Since Pine Script doesn't support pointers or traditional OOP, I rely on my own knowledge of data structures and algorithms to architect solutions that stay performant within the platform's strict memory and processing constraints.

Projects completed so far include:

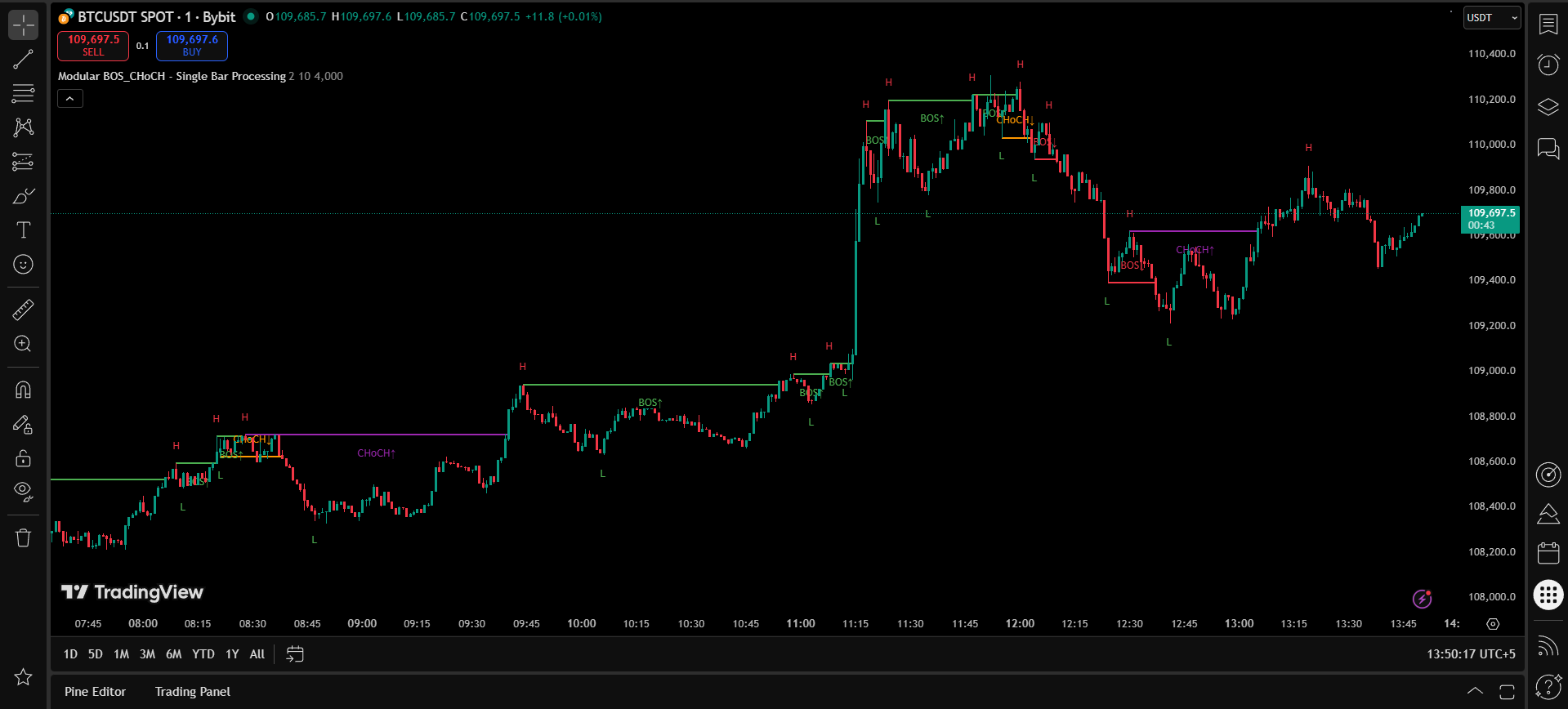

- Market structure detection systems — algorithmically identifying Break of Structure (BOS), Change of Character (CHoCH), pivot points, and structural breaks using multi-phase processing pipelines that store, analyze, and validate bar data across thousands of bars using map-based architectures

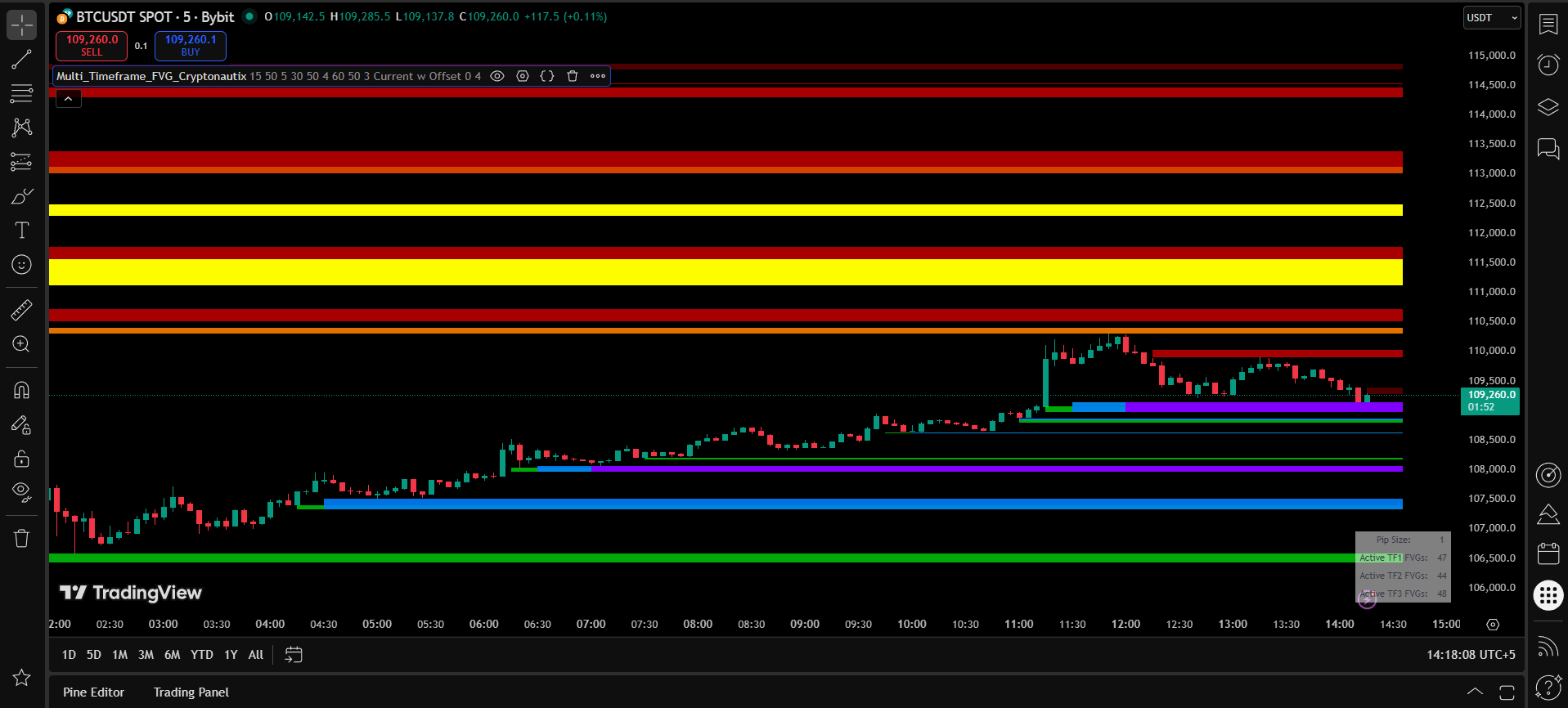

- Multi-factor confluence indicators — combining engulfing candle detection, Fair Value Gap analysis, RSI divergence filtering, and volume pattern recognition into single integrated systems where each component cross-validates the others before a signal is generated

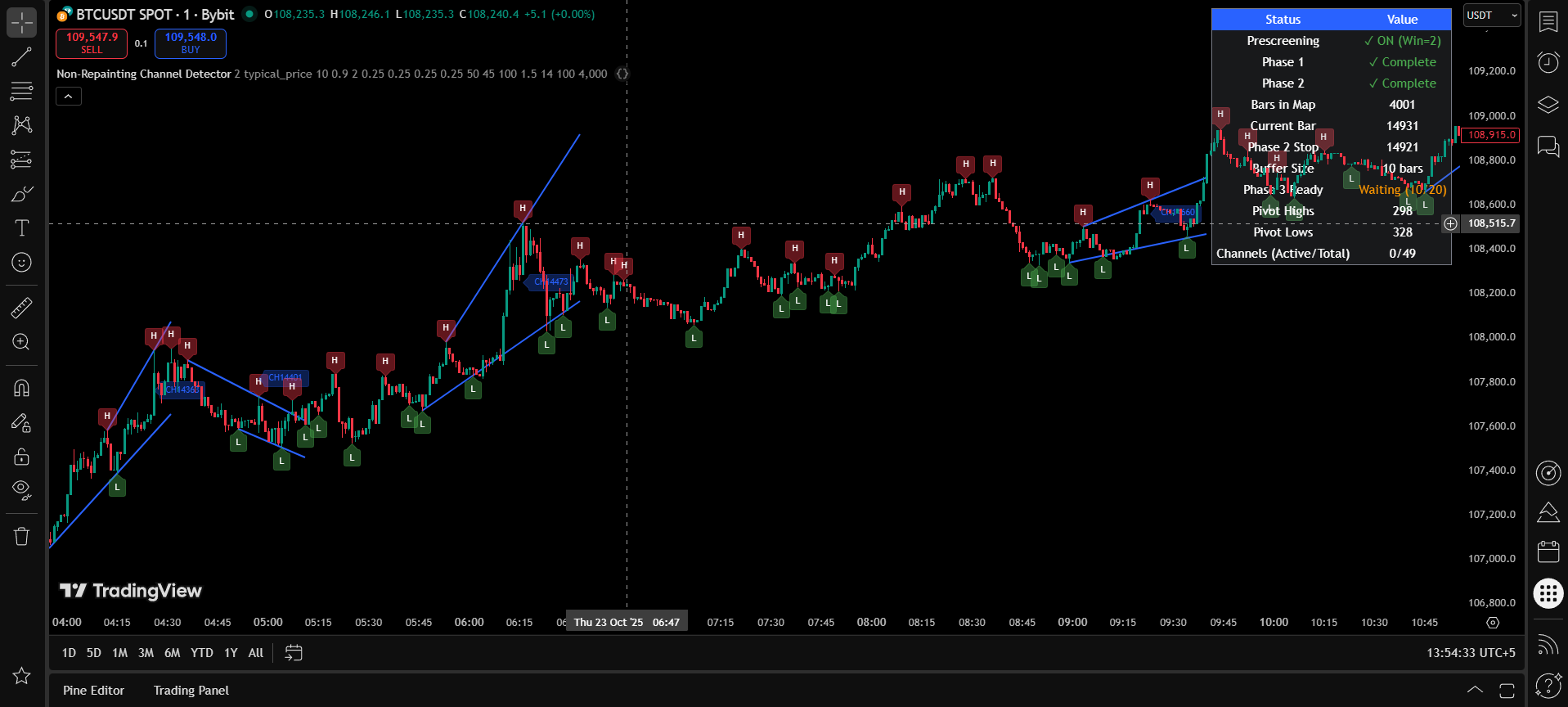

- Trend and pivot detection using mathematical decay methods — four independent weighting functions (EMA, linear, exponential, and Gaussian decay), each computed manually from map-stored data with left-side and right-side analysis, weighted scoring, and anti-repainting buffer zones

- Adaptive window pivot and sweep detection — dynamically adjusting detection sensitivity using ATR and ADX normalization, with configurable detection methods and liquidity pivot classification

- Volume analysis suites — multi-signal volume engines detecting highest volume events, follow-up confirmation, high-volume-large-candle confluence, and unusual spikes, with cross-symbol monitoring capability

- Candlestick pattern recognition — configurable multi-candle pattern detection (e.g., stairstep formations) with ATR-based validation, dual wick measurement modes, doji classification, and FVG-based filtering

All indicators and strategy scripts are built with anti-repainting, adaptive pip calculations across Forex, Crypto, Stocks, Indices, and Commodities, manual memory management for large datasets, and real-time alert systems with webhook support.

If your project requires more than a simple crossover or oscillator — if it involves real algorithmic logic, custom data handling, or multi-system integration — I can build it.