Guru provides a free 1099 tax service to U.S. based Freelancers and Employers. Our 1099 tax service simplifies the process of creating and submitting a 1099 tax forms at the end of the year. If you qualify for it and opt-in for our 1099 tax service, we will issue 1099 tax forms to your Freelancers every January, on your behalf.

In order to qualify, you must reside in the United States and pay at least $600 USD to a U.S. based Freelancer in a single calendar year. If you qualify to use this service, you must opt-in before December 15th. If you opt-in after the said date, we may not be able to provide you with this service.

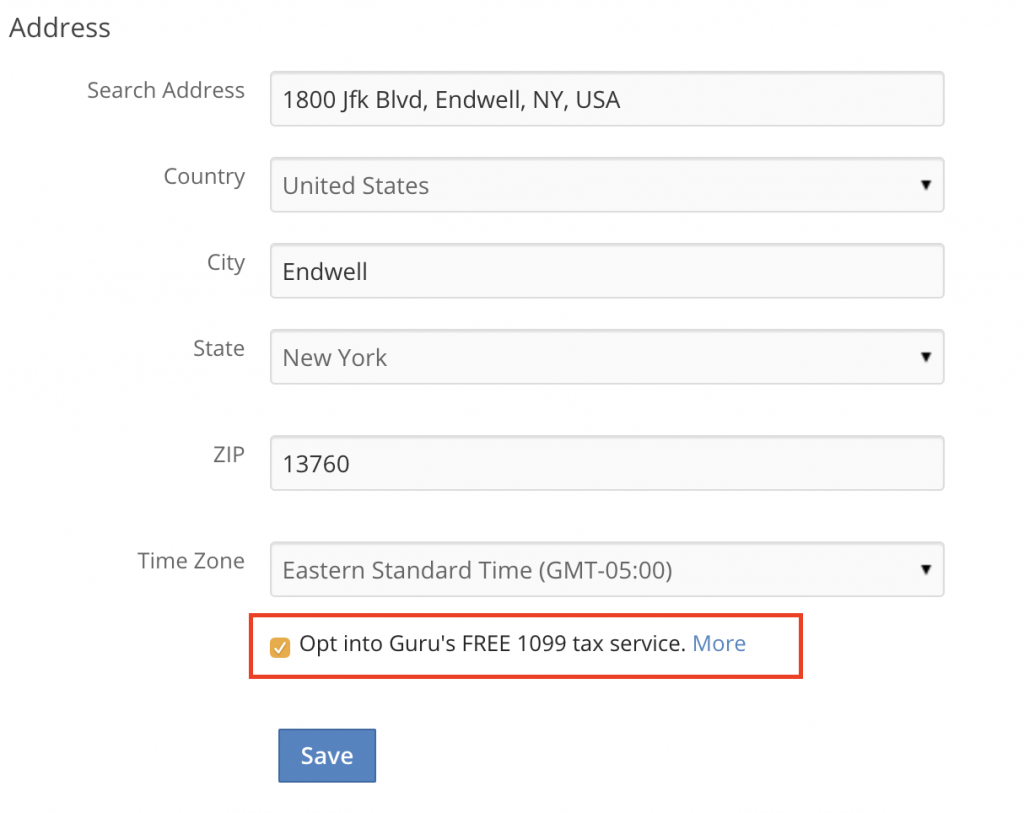

You can sign up for this service by visiting the “Contact Information” tab on Edit My Account page. Check the box to opt into Guru’s free 1099 tax service and save.

Invoices that you receive will include a status that indicates whether the 1099 service has been applied. You can view the 1099 service status by clicking the relevant invoice number on the Payments page. Look for the 1099 line and you’ll see one of following status:

- Yes: Service was applied to this invoice

- No: Service was not applied to this invoice

- NA: Service is not applicable to this Freelancer

Note:

- Our free 1099 tax service does not work retroactively. Only payments received after the opt-in date will be represented.